Hempfield residents remain unhappy about school district's assessment-appeal policy

Assessment Appeals in Hempfield

Hempfield school board officials voted 5-4 on Sept. 17, 2018, to raise the threshold for assessment appeals from 0,000 to 0,000 over assessed market value.

Hempfield school directors raised the threshold for property tax assessment appeals by $150,000 on Monday night, but it did little for those who feel the district’s policy is singling out residents and amounts to “spot” appeals.

Residents turned out in large numbers at a previous board meeting to level criticism at the district’s assessment-appeal policy , which challenged tax assessments on properties that have sold for more than $100,000 over their assessed value.

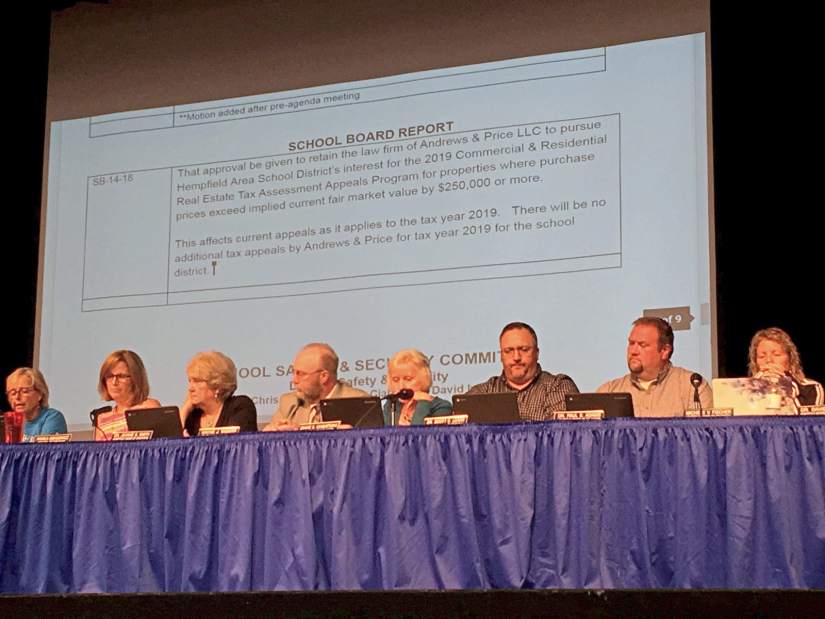

At its meeting Monday night, the school board voted 5-4 to retain a Pittsburgh law firm that has been pursuing the appeals, and to raise the threshold to $250,000. Board President Sonya Brajdic said she hoped it would satisfy many of the more than 70 people who attended the meeting and those who signed up to speak.

It did not.

“I still think there are issues and problems with this entire program,” said resident Alan Fleissner.

“This doesn’t come across as being fair,” said Candace Cieslo, whose family moved into the district last year. “It comes off as being targeted.”

Cieslo and others said the program would discourage developers from investing in the district.

“Why would anyone invest in a community if they feel their taxing system is unstable?” she asked.

Resident Wayne Freed referenced two bills in the state’s previous General Assembly session aimed at curbing the assessment-appeal process statewide, and asked the board to wait until Pennsylvania lawmakers decide what direction to go.

Resident Nancy Fischione received an assessment-appeal letter but found out Monday night that, with the dollar figure bumped up to $250,000, she is no longer affected.

“This process is still wrong,” she told the board. “What you’ve probably done is change this crowd to a new crowd, once they receive letters.”

Pittsburgh law firm Andrews & Price was retained by the district to carry out the appeals assessments. Brajdic and board members Jeanne Smith, Diane Ciabattoni, Michele Fischer and David Iwig voted to modify the policy.

Resident Dana Smith said he has spoken with several homeowners in anticipation of a possible legal challenge.

“This is principally wrong,” Smith said. “Please do not force me into a court of law. I will not back down.”

Smith and other residents accused the board of singling out individual homeowners for assessment appeals.

“We as a district do not go out and do spot assessments,” Brajdic said. “That is not our job.”

Resident Scott Graham said the district should get out of the assessment business.

“Property assessments should be the responsibility of Westmoreland County government, not the Hempfield Area School District,” Graham said.

Westmoreland has not had a countywide reassessment since 1973.

Patrick Varine is a Tribune-Review staff writer. You can contact Patrick at 724-850-2862, pvarine@tribweb.com or via Twitter @MurrysvilleStar.