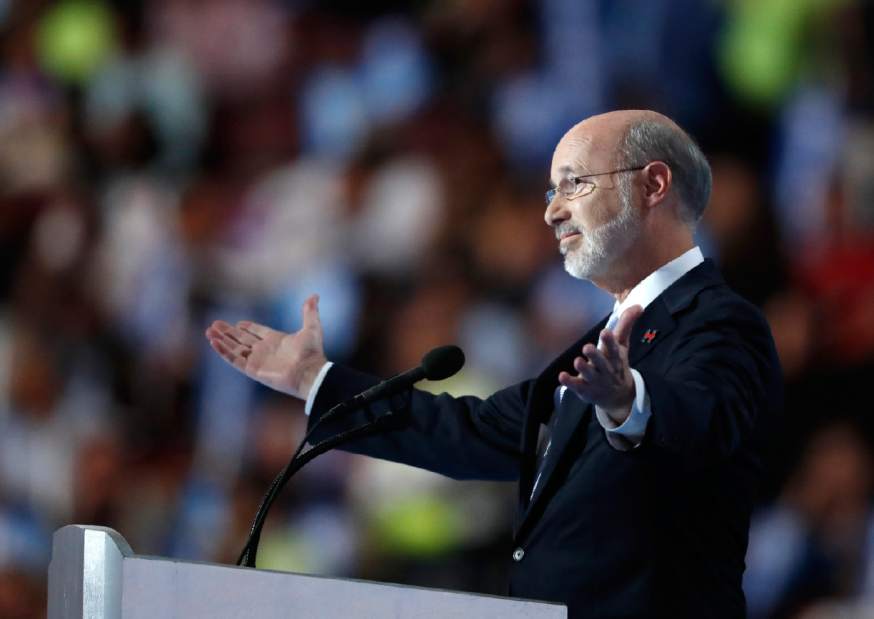

Wolf budget calls for natural gas tax, minimum wage increase

HARRISBURG — Gov. Tom Wolf's new spending proposal is only the start of the frenzied budget negotiating season in the state Capitol.

Republican leaders lauded parts of the governor's proposal, but indicated more expansive changes to public pension systems would be necessary before they'd approve parts of his proposal.

Wolf on Tuesday revealed a $32.3 billion spending package built on a combination of $2 billion in funding cuts and tax increases for next year's budget.

“In my proposed budget, there are no broad-based taxes,” Wolf said during an address before the combined houses of the Legislature.

He said the proposal “contains the largest cuts to, and consolidations of, government bureaucracy in our history.”

Significant pieces of the governor's proposed $571.5 million spending increase — 1.8 percent above the current year — will require approval from the Republican-controlled Legislature.

Wolf, a Democrat, proposed a 6.5 percent natural gas severance tax and impact fee credit estimated to generate $293 million.

Senate Majority Leader Jake Corman, R-Centre County, said Wolf's proposal was “wildly overstated in revenue,” particularly the severance tax projections.

That part of Wolf's proposal was met with the predictably dour response from the industry, which has opposed all of his attempts to increase taxes on shale gas.

“While we're cautiously optimistic that the national energy market may begin to recover from the recent global downturn, higher energy taxes — along with the Wolf administration's wave of job-crushing regulations — will stunt our industry's ability to reinvest in Pennsylvania, impacting tens of thousands of hardworking men and women who rely on a stable market for family-sustaining jobs,” the Marcellus Shale Coalition said in a statement.

“We understand the tough budget challenges ahead,” the statement said, but maintained Pennsylvania's “unique natural gas tax — called the impact fee — has generated more than $1 billion in new revenue for communities.”

In his address, Wolf mentioned neither his proposed natural gas severance tax nor the fee for local municipalities that rely fully on state police protection .

Wolf's plan additionally anticipates about $489.8 million in tax loophole eliminations. It relies on the Legislature approving a minimum wage increase to $12 per hour, which would generate an estimated net revenue gain of $95 million.

The proposal would boost state basic education funding by $100 million, special education funding by $25 million and pre-K and Head Start by $75 million.

The governor also proposed slashing state funding for student transportation by $50 million, saying the funding formula is outdated.

Community colleges and so-called “state-related” universities such as University of Pittsburgh and Penn State University would be flat-funded. State-owned universities, including California and Slippery Rock, would see a funding boost.

Pension costs problematic

Corman criticized Wolf for not doing enough to address public pension system costs, an issue Senate Republicans plan to push as negotiations progress.

“What's telling was what's not in this proposal,” Corman said. “We could do all the things the governor suggested here today, and we'll be right back here next year looking at a deficit because we have not addressed the public pension problem in Pennsylvania.

“I think we're all willing to swallow some pain to balance the budget if we solve problems,” he added.

Senate President Pro Tem Joe Scarnati, R-Jefferson, said if lawmakers enact these proposals and taxes “without making these structural changes, you will be back at taxing once again in three or four years. The cost drivers, and most importantly the pension reform that's needed, is a critical part of how we move forward.”

Wolf spokesman J.J. Abbott said the governor still wants to work with the Legislature on pension reforms. Two bills Wolf was open to signing last session never reached his desk, Abbott noted.

Wolf's proposal does include some pension-related reforms, but not the sweeping changes Republicans want. The governor calls for an early retirement incentive program for state workers who are within five years of retirement. He also would consolidate investment offices for the two pension systems for state workers and school district employees to reduce fees to investment managers.

Consolidation concerns raised

Corman continued to express skepticism of Wolf's proposal to consolidate the state's Health, Drug & Alcohol Programs, Human Services and Aging agencies into a single Health and Human Services Department, which the administration estimates would have more than 18,000 workers.

“The Department of Human Services is already one of the largest in the country, and now we're gonna make it on steroids,” Corman said. “Are we creating a bigger bureaucracy or are we creating savings? That's what we need to find out.”

The Wolf administration estimates taxpayers would save $104 million by consolidating the four departments and merging the corrections department and the board of probation and parole into the Department of Criminal Justice.

Costa touts efficiencies

Sen. Jay Costa, D-Forest Hills, said Wolf is offering Republicans what they've asked for: “efficiencies in state government, restructuring of state government, nominal revenue enhancements along the line of trying to balance our budget, and looking to hold people accountable, specifically the business community as it relates to grants and ... tax credits.”

The governor wants to claw back loans and grants from companies that fail to meet job creation promises, Costa said.

“This overall budget process envisions that there will be more efficiencies that will result in a lower number of employees,” he said. “Smaller government, smaller structure of government, a new structure of government, consolidation of agencies — these are all the things folks have asked us for, and the governor's proposal delivers that.”

Budget Secretary Randy Albright said the state won't end the current fiscal year with a budget in balance. The administration proposal includes rolling a $605 million shortfall into the next fiscal year. That shortfall estimate is lower than the $715 million one projected by the Independent Fiscal Office for the current year.

Kevin Zwick is a Tribune-Review staff writer. Reach him at 724-850-2856 or kzwick@tribweb.com.