https://archive.triblive.com/news/wire-stories/westinghouse-files-for-bankruptcy-protection-2/

Westinghouse files for bankruptcy protection

REUTERS

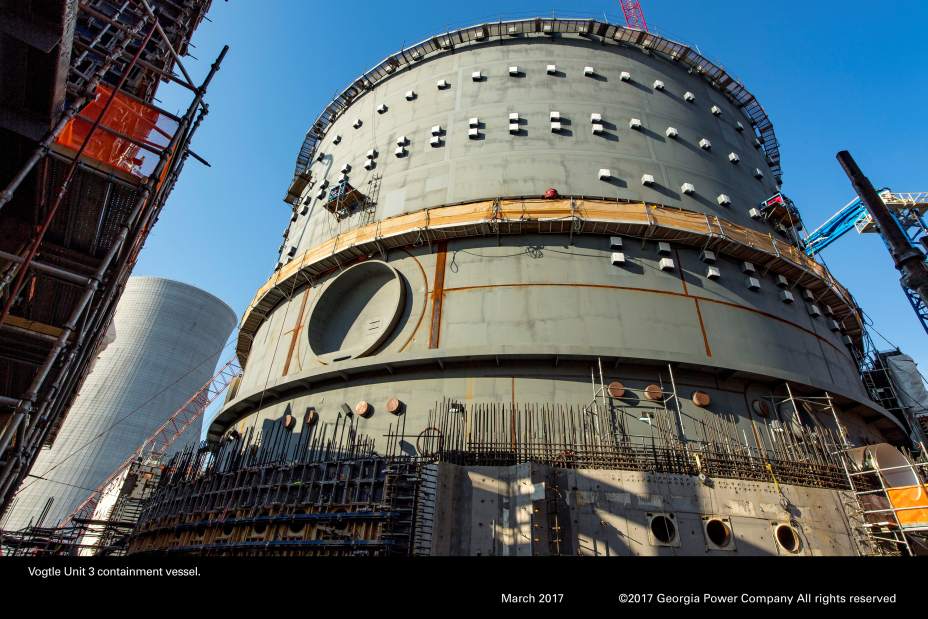

The Vogtle Unit 3, being constructed by primary contactor Westinghouse, a business unit of Toshiba, near Waynesboro, Ga., is seen in an aerial photo taken in March 2017.

Westinghouse, an iconic Western Pennsylvania company with deep roots across the region, filed for bankruptcy Wednesday. However, the potential impact on local jobs could be minimal.

The company's Chapter 11 bankruptcy comes amid financial turmoil in the U.S. nuclear power industry for Toshiba, the Japanese electronics giant that bought the Cranberry-based company in 2006, and Westinghouse nuclear power plant projects under construction.

Many of Westinghouse's 4,500 employees in Western Pennsylvania support existing power plants with maintenance, rebuilding and efficiency work and are not involved in new construction or expansion, company employees and energy experts told the Tribune-Review.

Josh Hickman, president of the Young Professionals in Energy networking group in Pittsburgh, said Westinghouse is big enough and diverse enough to weather bankruptcy and potentially emerge as a better company.

“I don't think there is going to be a mass layoff or anything of that nature,” said Hickman, who runs a geological consulting company. “Westinghouse has that specialized knowledge, long-term contracts, and I think they are going to be even better.”

Westinghouse has about 2,500 employees at its Cranberry headquarters and about 2,000 scattered across nuclear fueling, servicing and related operations in Churchill, Madison, Blairsville and New Stanton.

Westinghouse, which employs about 12,000 worldwide, didn't say Wednesday if the bankruptcy would result in layoffs. The company intends to reorganize itself and emerge from bankruptcy, spokeswoman Sarah Cassella said.

“(The) announcement does not mean that we are going out of business, but rather we have been given the exclusive right to develop a plan of reorganization — which is the path we will take to resolve our financial challenges,” Cassella wrote to the Tribune-Review.

Cranberry Manager Jerry Andree said the bankruptcy was not unexpected and that he was optimistic about its future. Westinghouse relocated its headquarters from Monroeville to a four-building Cranberry complex in 2009. The complex is in a Strategic Development Area, and the company is exempt from property taxes, Andree said.

Most workers there are nuclear, electrical or mechanical engineers, and the remainder hold administrative positions in the finance, purchasing and legal departments.

“Westinghouse has a long history of successfully managing the challenges of the industries they serve. They are a resilient company with many talented employees serving a global demand for their expertise. There is every reason to believe they will overcome this current challenge and continue to be a leader in their field,” Andree said in a statement.

Churchill Manager Donna Perry said the borough hasn't heard from Westinghouse what might happen to the facility on Beulah Road. She said if Westinghouse abandoned the property, which is assessed at about $6.8 million, the borough could lose about $41,000 in property taxes and another $3,100 in local services taxes. Perry said $41,000 is a big sum for the borough to lose.

“Every little bit hurts,” Perry said, noting that Churchill has a declining tax base as is. “To me, $41,000 is not a little bit.”

The bankruptcy ends the decade-long marriage of Westinghouse and Toshiba. Toshiba — which wants to sell Westinghouse — blames the company for its financial woes.

Toshiba has written off more than $6 billion in losses connected to its U.S. nuclear business, citing accounting problems, delays and cost overruns. And it has pulled back from new nuclear projects under discussion in India and Britain.

Elaine Luther, a Point Park University business professor, was critical of business decisions made by Toshiba and Westinghouse during the past decade. Luther thought it was a bad decision for Toshiba, which was looking to expand into a new industry, to choose nuclear power and acquire Westinghouse, something far removed from its core business of electronics manufacturing.

“They don't want to be in this business anymore, which is not surprising,” Luther said of Toshiba and nuclear power. “It looks like Toshiba thought we'd actually be green and be into nuclear energy and move away from coal, and it doesn't look like that's going to happen under the current administration.

“It's so typical of a merger and acquisition that doesn't look good after it happens.”

Luther questioned why Westinghouse spent money to move its headquarters from Monroeville to Cranberry in 2009 and then in 2015 acquire Texas-based nuclear construction company CB&I Stone and Webster Inc., which was building Westinghouse's AP1000 reactors in Georgia and South Carolina.

“Architects don't run construction companies. ... It's such a different business,” Luther said. “They could have been spending their money on (research and development) to come up with safer nuclear technology. Instead, they are spending it on an acquisition.”

Luther said there is a good chance Toshiba will be able to sell Westinghouse. Her concern is who would buy it and what it would mean for the United States' technological foothold in nuclear power.

The United States relies on nuclear energy to provide about 20 percent of its electricity needs. Yet the reactors, with an average age of 35, are getting old by industry standards.

“As these units get decommissioned, to stay at that percentage you need more units,” said Dan Aschenbach, a senior vice president at Moody's. “But you can't get there if you cannot construct it.”

Few companies are able or willing to swallow Westinghouse. One possibility is Korea Electric Power Co., which already has a nuclear engineering subsidiary. The Chinese nuclear construction company also might be interested in the technology.

But KEPCO already builds its own brand of nuclear plant, and China has its own CAP 1000. Moreover, the U.S. government would have to approve any sale to another foreign company.

“There is a lot of value in that design going forward, and a lot of the challenges are being dealt with right now,” said Jeffrey Merrifield, a former member of the Nuclear Regulatory Commission now at the law firm Pillsbury Winthrop Shaw Pittman. He said there are “a variety of coalitions forming” of U.S. companies that might be interested in purchasing Westinghouse. But those firms might only want certain pieces of Westinghouse, which designs a variety of reactor parts.

Another wrinkle is that the Energy Department provided more than $8 billion in loan guarantees to help finance AP1000 reactors Westinghouse was building at Southern Co.'s Vogtle facility near Waynesboro, Ga. Those guarantees were given to the utilities, so the U.S. government and taxpayers should not be liable for any losses.

In seeking Chapter 11 protection, Westinghouse still could finish building those plants.

Westinghouse said it has arranged $800 million in debtor-in-possession financing so that it can continue to serve customers while restructuring its business. Cassella said the company will continue to staff its global business units. It could hire employees in some areas while laying off employees in others as it restructures.

The collapse of Westinghouse reverberates through the global nuclear business. The company supplied the world's first commercial pressurized water reactor 60 years ago, and half of the world's 430 nuclear power reactors have Westinghouse technology.

Moreover, Westinghouse had claimed that its new AP1000 model had passive technology and a modular design that was safer, cheaper and faster to build. Many U.S. lawmakers and nuclear industry officials say the AP1000 could augur a “nuclear renaissance” in the United States.

Westinghouse is in charge of constructing four of these reactors at two sites: two being built by SCANA at the Virgil C. Summer Nuclear Generating Station, about 20 miles northwest of Columbia, S.C., and two in Georgia.

Westinghouse ran into trouble on both sites. Angry about delays and cost overruns, the owners of the nuclear plants filed claims against Westinghouse. A settlement was reached, but now the legal battles will begin again.

The Washington Post contributed to this report. Aaron Aupperlee is a Tribune-Review staff writer. Reach Aupperlee at aaupperlee@tribweb.com or 412-336-8448.

Copyright ©2026— Trib Total Media, LLC (TribLIVE.com)