Wolf vetoes $30.1 billion budget pushed by GOP

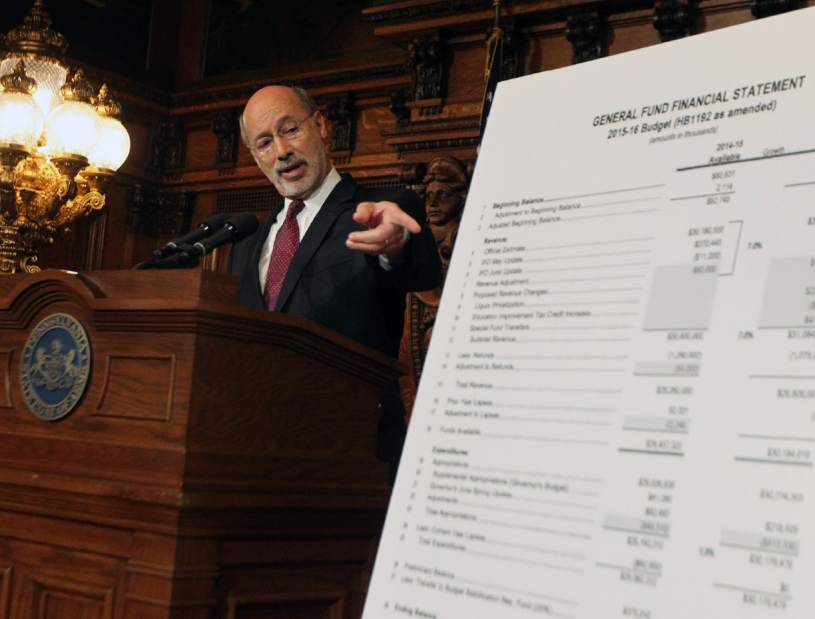

HARRISBURG — The General Assembly on Tuesday sent a $30.1 billion budget that doesn't raise taxes to Gov. Tom Wolf, who vetoed it.

“It's what I feared,” Wolf said at a news conference. “I'm going to veto the entire budget.”

“You can't argue with arithmetic,” he added. “This budget simply is not balanced.”

He says he is inviting legislative leaders to a meeting Wednesday afternoon to resume negotiations.

The full budget veto is historic; Wolf's office and legislative leaders say it hasn't occurred in at least 40 years, and they are not sure when it may have occurred before that.

The GOP plan contrasts with “tax increases of historic proportions” the Democratic governor proposed in March, said Senate Appropriations Chairman Patrick Browne, R-Allentown.

Approved by the House on Saturday and the Senate on Tuesday, the Republican legislation moves the state toward a budget impasse.

Senate Majority Leader Jake Corman, R-Centre County, said lawmakers met their responsibility to pass a budget by Wednesday's start of the fiscal year.

“If the governor vetoes it, so be it,” Corman said. “I'll be here (Wednesday) to work with the governor, and the next day through the Fourth of July. I'll be here, whatever it takes to get it done.”

The General Assembly took historic action in approving a bill to privatize the liquor system. Grocery and convenience stores could sell limited amounts of liquor and wine, and beer distributors could sell unlimited amounts giving consumers the “one-stop shop” they want, supporters said. At risk are more than 4,000 state Liquor Control Board jobs as state stores are phased out.

Another Republican-crafted bill would save more than $10 billion over 30 years by eliminating guaranteed pensions for new employees, who would get 401(k)-type plans, supporters claimed.

Legislators are ”leading by example” by taking the 401(k)-type plans if they are re-elected, House Majority Leader Dave Reed, R-Indiana said.

Even if the budget is delayed, state employees will be paid, and it may be a month or more before delayed payments impact vendors. Small nonprofit organizations that get state money were the hardest hit in a 101-day impasse in 2009.

Democrats decried the budget as one based on “tricks and ideology.”

“It's disappointing that Republicans are advocating this kind of gimmicky, irresponsible nonsense rather than negotiating a real budget in good faith,” said Sen. Wayne Fontana, D-Brookline. “If this spending plan were to become law, our deficit would more than double to $3 billion within two years.”

He said the budget “exhausts every one-time revenue expenditure in sight, shifts line items around, and relies heavily on accounting tricks.”

The Senate voted 30-19 and the House, 112-77, largely along party lines.

For the first time, lawmakers included money in a state budget from selling state Wine & Spirits stores and leasing the state's wholesale control of liquor and wine. The budget counts on $220 million annually from what the GOP calls liquor reform.

Wolf opposes selling the state stores but hasn't said he would veto a separate liquor bill, spokesman Jeffrey Sheridan said. Wolf likewise will review the pension bill before deciding, Sheridan said .

Wolf wants to shift away from school property taxes by raising income and sales taxes, and to tax natural gas extraction. The GOP plan doesn't include tax-shifting or a Marcellus shale gas tax.

“This budget isn't balanced and underfunds education,” Sheridan said.

Republicans say Wolf's plan would raise taxes more than $4 billion and increase state spending 16 percent. The Independent Fiscal Office, in an April report about Wolf's budget, said all classes of taxpayers would pay more.

Sen. Don White, R-Indiana County, said of the proposed shale tax: “Let's not push this industry away. Let's look at the facts. Let's look at the reality.” He referred to Halliburton's announcement Tuesday that it will close its Homer City office and move it to Zanesville, Ohio, resulting in 90 lost jobs.

A shale tax is popular because “people have demonized the energy industry,” said Sen. John Eichelberger, R-Altoona. But he said natural gas companies are “teetering on pulling out or downsizing.”

As the Senate passed the liquor bill and budget, the House debated the pension bill, which would place new employees under defined contribution plans, such as a 401(k). Guaranteed pensions aren't sustainable for taxpayers, Republican lawmakers said.

Brad Bumsted is Trib Total Media's state Capitol reporter.